Accounting for VAT in a nutshell

Value Added Tax (VAT) is used in most countries with the notable exception of the USA. It does go under various names; GST, IVA etc, but they are they are all work broadly the same.

The key concept is that if your business is registered for VAT you add VAT to your sales, and can claim back the VAT you pay on purchases. This article will briefly describe VAT in the UK and for a more detailed discussion, please see: Cnossen, Sijbren, A Vat Primer for Lawyers, Economists, and Accountants (August 17, 2009). Tax Notes, Vol. 124, No. 7, 2009, Available at SSRN

Raising a Sales Invoice

When you raise a Sales Invoice you must add the VAT. Most of the time this will be at the ‘Standard Rate’ of 20%, but Exports do not incur VAT, and some products (eg: food & children’s clothing) are reduced or zero rated. There are special situations where the VAT my be varied, such as some goods/services provided to registered charities and some financial products. So lets take the example of a Sales Invoice for £2,000 plus 20% VAT. These are typically the posting you would use.

Sales Invoice for £2,000 plus £40 VAT | Db | Cr |

| 12001-Accounts Receivable | 2,040 | |

| 24107-Sales VAT Control Account | 40 | |

| 40001-Revenue | 2,000 |

Adding a Purchase Invoice

When you receive a Purchase Invoice the Net and VAT amount on the invoice are posted as follows.

Purchase Invoice for £1,500 plus £30 VAT | Db | Cr |

| 20000-Accounts Payable | 1,530 | |

| 12210-Purchase VAT Control Account | 30 | |

| Expense Account | 1,500 |

Closing the VAT Period

Most companies submit their VAT return quarterly, the exact dates vary from company to company. The VAT Return must be submitted within 1 month plus 7 days of the period end so if your VAT period is January – March, the return must be submitted by 7th May. Any tax owed must also be paid by that time and your liability is the VAT on Sales less VAT on allowable Purchases.

Close VAT Period | Db | Cr |

| 24107-Sales VAT Control Account | 40 | |

| 12210-Purchase VAT Control Account | 30 | |

| 24108-VAT Liability | 10 |

Paying HMRC

At this point the Sales & Purchase VAT Control Accounts will be zero, but you will have a £10 liability to pay to HMRC.

Pay HMRC | Db | Cr |

| 10051-Bank | 10 | |

| 24108-VAT Liability | 10 |

Registration – Cash or Accrual

Companies with a turnover greater that £85,000 must register for VAT, but there are two different schemes. Companies with a turnover of £1.35 million or less can use the ‘VAT Cash Accounting Scheme’ but over that you must use Accrual based VAT.

£1.35 million or less

http://www.taxhistory.org/www/freefiles.nsf/422efdb8b12550d585256cfa00812512/308f39bfcb20ced785257831006bcd0c/$FILE/CNOSSEN-3.pdf

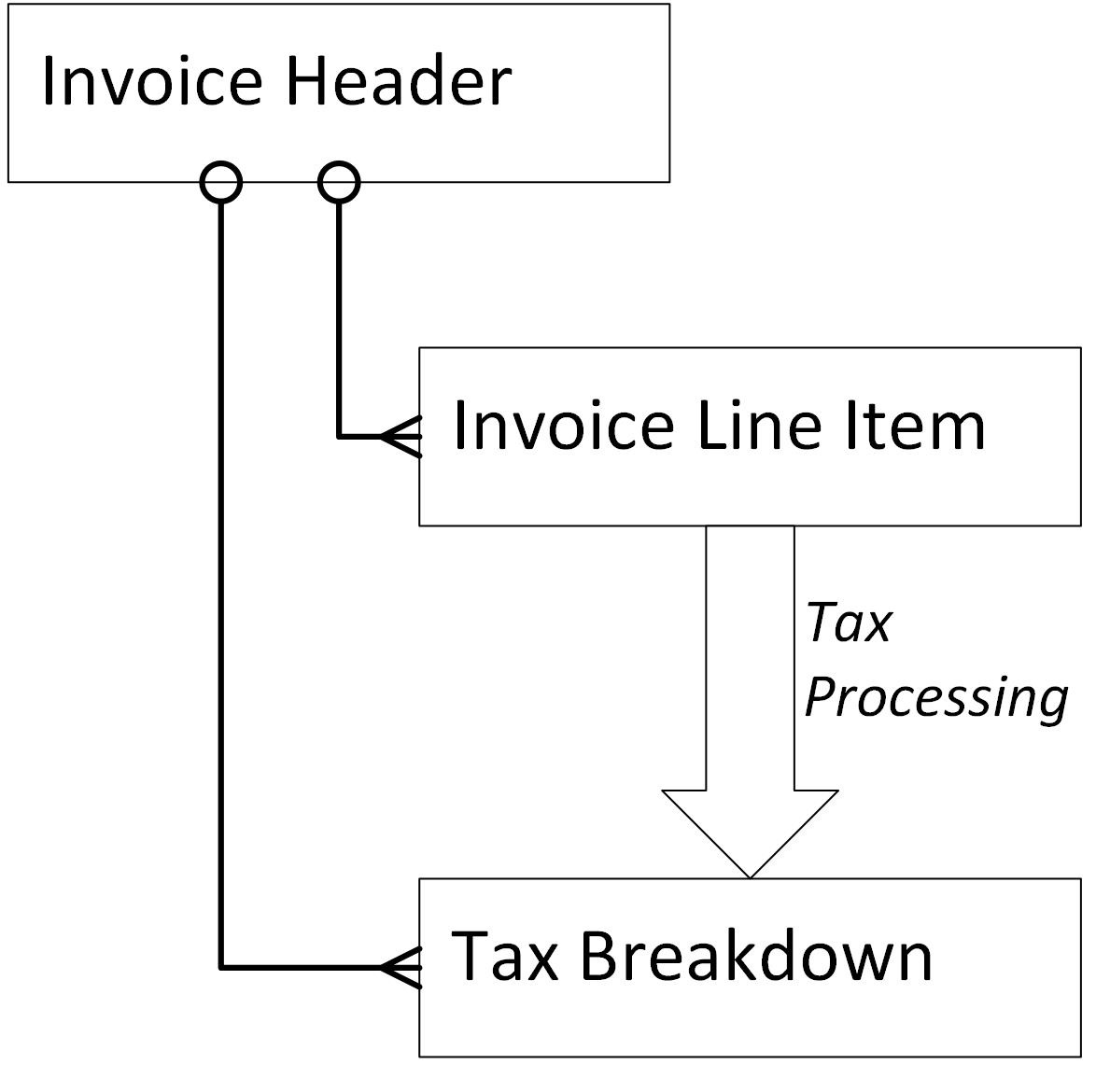

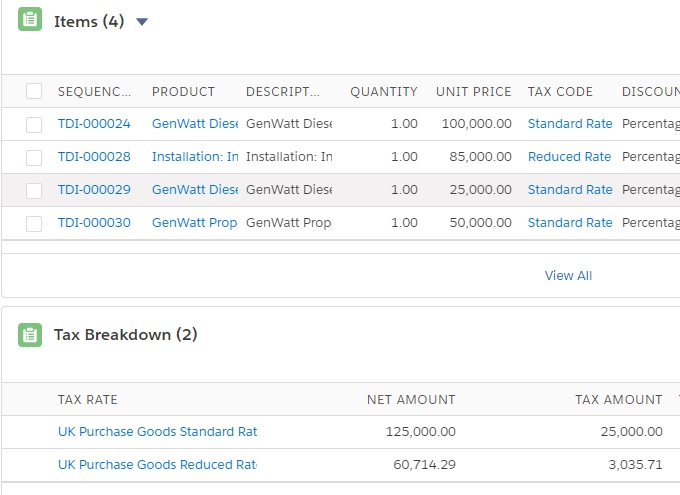

‘Tax Breakdown’ is the key to how VAT is handled in Sage Financials. In a previous article I went over how Tax is configured in Sage Financials, so let’s look at how Tax Breakdown works when you process invoices.

Each Invoice Line Item has a Tax Treatment and a Tax Code. These two are combined to work out the Tax Rate. As you enter Line Items, Sage Financials sums together the different Tax Rates and creates the Tax Breakdown:

In this example four line items result in two Tax Breakdown records.

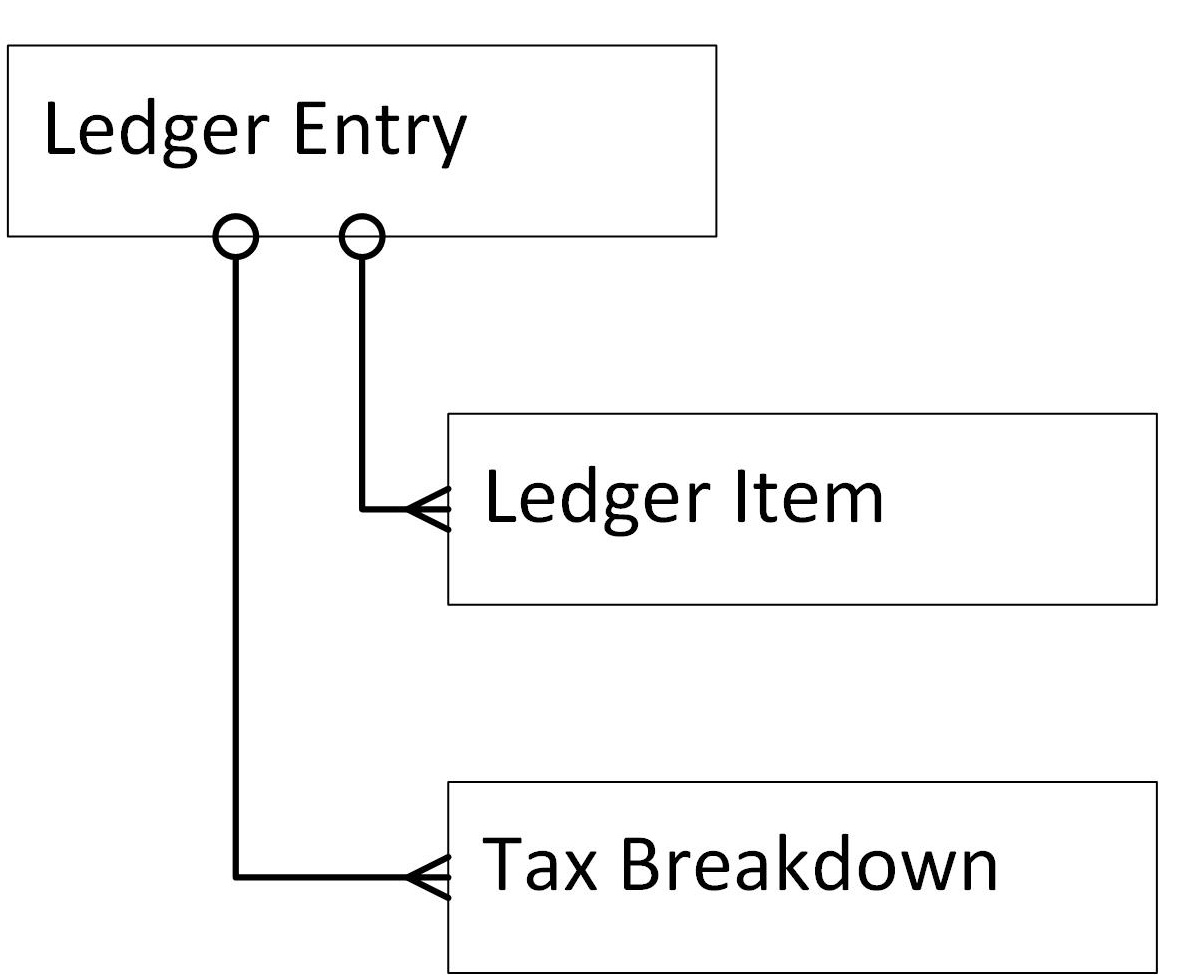

When you Post the Invoice you generate a Ledger Entry, Ledger Items and Ledger Entry Tax Breakdown records:

And it is the Ledger Entry Tax Breakdown records that are used to populate the boxes on your VAT Submission form and reports.

Reverse Charge

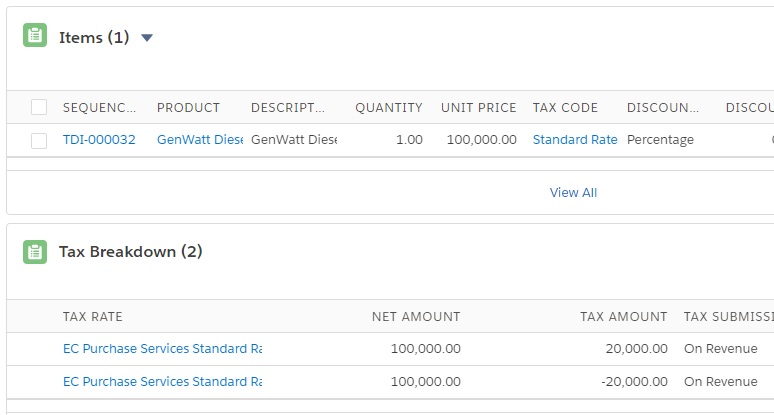

When purchasing from the EU or purchasing goods from outside the EU, the Reverse Charge rules apply. In Sage Financials this is handled by creating two Tax Breakdowns:

The net effect on your VAT Liability is zero, but it allows Sage Financials to fill in Box 2 and Box 4 correctly.

Tax Treatment and your VAT form

It is perhaps worth revisiting the definitions HMRC use for the 9 VAT Boxes:

- Box 1: VAT due in the period on sales and other outputs

- Box 2: the VAT due in the period on acquisitions from other member states of the EU

- Box 3: total VAT due

- Box 4: VAT reclaimed in the period on purchases and other inputs (including acquisitions from the EU)

- Box 5: net VAT to pay to HMRC or reclaim

- Box 6: total value of sales and all other outputs excluding any VAT

- Box 7: the total value of purchases and all other inputs excluding any VAT

- Box 8: total value of all supplies of goods and related costs, excluding any VAT, to other EU member states

- Box 9: total value of all acquisitions of goods and related costs, excluding any VAT, from other EU member states

Each Tax Treatment can effect different VAT Boxes as show:

| Tax Treatment | Box 1 | Box 2 | Box 4 | Box 6 | Box 7 | Box 8 | Box 9 |

| UK Sale Goods/UK Sale Services | Tax | Net | |||||

| EC Sale Goods UK/EC Sale Services UK/General Export | Net | Net | |||||

| UK Purchase Goods/UK Purchase Services | Tax† | Net† | |||||

| EC Purchase Goods UK | Tax† | Tax† | Net† | Net† | |||

| EC Purchase Services UK/UK Import of Services | Tax† | Tax† | Net† | Net† | |||

| UK Purchase in Reverse Charge | Tax† | Tax† | Net† | ||||

| UK Import of Goods | Net† |

† Reverse Charge creates two Tax Breakdowns for each Tax Rate: one negative with a Tax Code Dimension Tag ending in ‘.Output’ and one positive ending in ‘.Input’. This means the net Tax is zero, but only the positive ‘.Input’ rates are used in the VAT Submission.

VAT Reporting

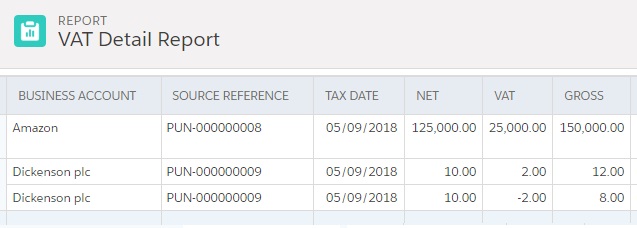

Sage Financials provides several VAT reports, including EC Sales List which you may be required to submit, along with other reports to help you check you VAT. There is also a VAT Details report, but you may find this does not display the detail you are really after. There can be a miss-match between the reports & the VAT Submission, but the VAT Submission is the one to trust. Get in touch if you are having issues with this.

Alpha Index have developed a plugin that creates a more complete detail report, showing the VAT Breakdown for each Invoice Item. You can download a free trial here.

Download the VAT Detail Report Plugin

This is not advice

This material is provides as a general guidance for informational purposes only. Accordingly, the publisher does not provide advice. The use of this material is not a substiture for the guidance of a lawyer, tax or compliance professional. When in doubt, please consult your lawyer, tax, or compliance professional for counsel.

Coming up next:

In the final article on Sage Financials & Tax, I will look at which Tax Treatments you can use for different transactions.