Manual Adjustment of VAT

Sometimes you receive a purchase invoice and the VAT Amount does not exactly match the VAT calculated by Accounting Seed. MTD for Accounting Seed includes Tax Groups to help.

1. Enter the Payable (Purchase Invoice) in the normal way

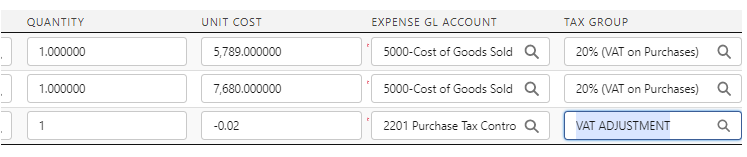

2. Add an extra line to the Payable:

- QUANTITY: 1

- UNIT COST: The adjustment amount – this can be positive or negative

- EXPENSE GL ACCOUNT: Your Purchase Tax Control Account

- TAX GROUP: ‘VAT ADJUSTMENT’

This will generate a single posting to the ‘Purchase Tax Control’ and the VAT added to the Box 4 total. For example:

- If you have a receipt for £100 plus £12 VAT (maybe a mixture of VATable and non-VATable items), Accounting Seed will calculate £20 VAT, but you can only reclaim £12.

- Adding a ‘VAT ADJUSTMENT’ line with -8.00 the correct amount will be posted to the ‘Purchase Tax Control’ account (£12).

- When the VAT Return is processed, the Box 4 value would be reduced by £8.00