Installing and configuring MTD for Accounting Seed:

We would normally do this as part of our configuration service, but here are the details if you want to know.

1. Install the Managed Package

Use this URL to install the Managed Package, or get in contract to make sure this is the most up-to-date version:

Please contact Alpha Index for the latest version.

Make sure you install for Admins only.

2. Allocate Permission Sets

MTD for Accounting Seed uses the permission set: ‘MTD for Accounting Seed Permission Set’

This should be assigned to all necessary users. (Check users assigned Accounting Seed Licenses)

3. Update Page Layouts Assignments

MTD for Accounting Seed comes with customised Page Layouts for the following Objects. Make sure the client has not done any other customisation of the Page Layouts before assigning them.

- Ledger: ‘Ledger Layout MTD4AS’

- Tax Group: ‘Tax Group Layout MTD4AS’

- Tax Rate: ‘Tax Rate Layout MTD4AS

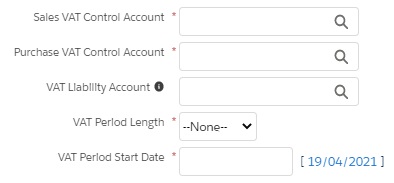

4. Update Ledger Tax Authrity

For each Ledger that will submit a VAT Return, setup the Tax Authority

5. Create the first VAT Return

Choose ‘MTD for Accounting Seed’ in the App Launcher and navigate to the ‘VAT Returns’ Tab

6. Setup the VAT Number

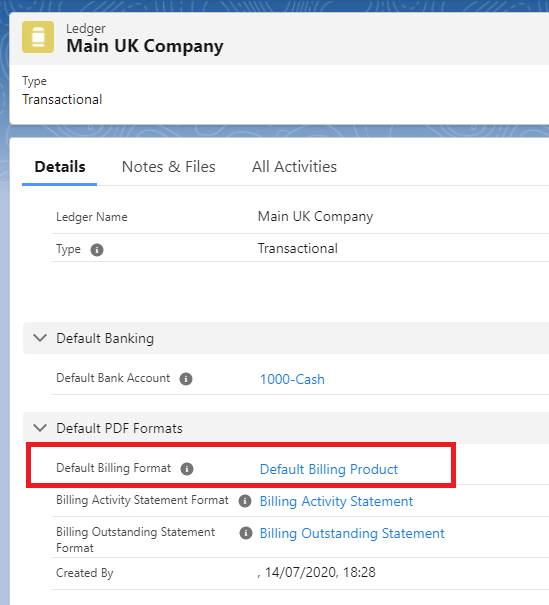

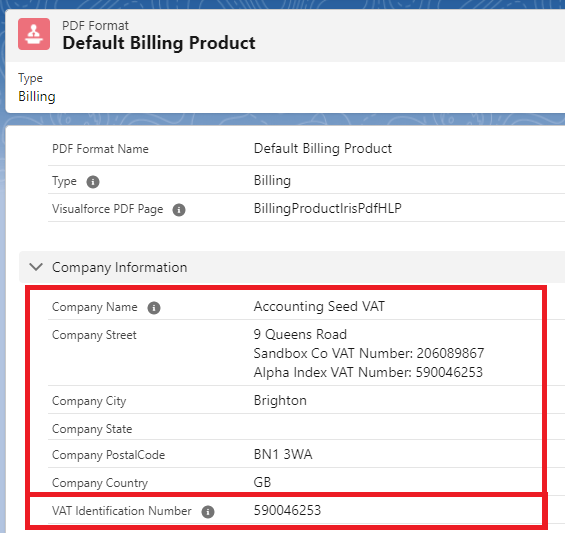

The VAT Number is an Accounting Seed field in the ‘Default Billing Format’.

From the VAT Return, click on the Ledger and then locate the ‘Default Billing Format’:

Click through to the ‘Default Billing Format’. Here you can edit the VAT Number and Address details that are displayed in the VAT Return:

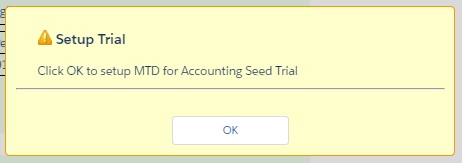

7. Setup Trial

NB: For Sandboxes and Developer Orgs the trial limit is not enforced

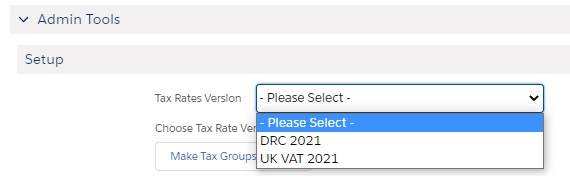

8. Configure Tax Groups

9. Install Remote Sites for HMRC Connector

The HMRC connector requires Remove Site setting for:

- https://api.service.hmrc.gov.uk

This is the end-point for the HMRC API - https://api.ipify.org

This is used to detect the User IP Address which is required for HMRC fraud prevention.

These Remote Sites can be configured by installing this Unmanaged Package:

https://login.salesforce.com/packaging/installPackage.apexp?p0=04t4K000002SBeg

10. Validation Rules

Included in the package are validation rules to help good data entry. On installation the validation rules are NOT Active. Make sure the client is OK with these rules before activating them.

These validation rules are for ‘Billing Line’ and ‘Payable Line’

- Tax_Group (You must choose a Tax Group for this Ledger)

NB: Refunds create Billing Lines WITHOUT Tax Groups which will fail with this Validation Rule. To get over this you must set the Custom Setting ‘aiASVsettings.Mark Refund’ to true.

To handle multi-company setup where companies may not be using VAT, there is a field in the Ledger object ‘Tax Authority’. If this field is populated you have to enter a Tax Group.

YOU MUST setup ‘Tax Authority’ in the Ledger for this validation rule to work. - Tax_Authority (Tax Group invalid for the Tax Authority)

This is for multiple tax authorities. You can setup each Tax Group to a specific Tax Authority. That Tax Group can only be used with Ledgers that have the same Tax Authority.

NB: Tax Authority is a Picklist Field using the Picklist Value Set: ‘Tax Authority’. You can edit this Picklist Value Set in the client Org.

NB: To handle Accounting Seed ‘Payment of Account’ which generates dummy Billings without Tax Groups, the validation rule does not run if the Billing Line posts to the ‘Unapplied A/R GL Account’

11. Setup for Extended features

Irish VAT

Irish VAT is supported with VAT3 and RTD (Return of Trading Details). You need to set the ‘Tax Authority’ in the Ledger to ‘IE’ before creating the first VAT Return. You are then prompted for the Return Type when you create a new VAT Return.

Irish companies also need VIES returns and INTRASTAT returns if thye trades with the EU. (see below)

NI VAT

Northern Ireland is a special case as it is within the UK Tax Authority, but also needs EC Sales List and INTRASTAT returns if it trades with the EU. (see below)

In Custom Setting tick ‘Show All Return Types’ so these additional options are available.

For Northern Ireland you may need to add the ‘Tax Rate Version’ ‘UK EU Tax Groups’ in the Admin Tools section.

ROW

Additional countries are supported using the Report Headings fields in Tax Rates. You may need to add additional 2-digit ISO Country Codes to the Global Picklist ‘Tax Authority’

EU Trading Statistics

For trading between EU countries (and between EU and Norther Ireland) there are additional requirements:

- VIES or EC Sales List

This is for all exports to other EU Countries or NI

VIES is the name used in ROI, EC Sales List is the name used in NI - INTRASTAT

This is for export and import of GOODS to and from EU Countries or NI

These require additional fields to be added to the Page Layout and populated:

- Account: VAT Business Identification, Tax Authority (VIES & INTRASTAT)

- Product: Commodity Code, Supplementary Unit, Country of Origin, Mass in kg, Method of Transport (INTRASTAT)

- Payables: NoTC (INTRASTAT)

- Billings: NoTC (INTRASTAT)

Goods or Services

The VAT Return has a field which controls how we determine Goods or Services

- VAT Return: Use Product Trade Type

If this is true the ‘Goods or Services’ will be defined by the Product. Otherwise it is defined by the Tax Group

Improved workflow:

The INTRASTAT return requires detailed information about the Product. This information is often included on the supplier invoice and/or delivery note so this information is best entered when you enter an invoice.

If you enter an invoice line with a Product, if the Product INTRASTAT values are setup, the values are taken from the Product. However, these values can be overwritten in the invoice line, and values from the invoice line pushed back to the Product.

For more details on this, please contact Prodigy.

Multi-Tax Authority setup

In some cases a company is registered for VAT with more than one Tax Authority. (This is typical with Irish and Northern Irish companies where they can be registered for both IE and GB VAT)

The Custom Setting ‘Multiple Tax Authorities’ must be ticked. This means you are prompted for the Tax Authority when you add a new VAT Return. This means you need to tweak the Permission Set to give Edit permissions to the ‘Tax Authority’ field in ‘VAT Return’.

For the first VAT Return you need to make additional changes.

- VAT Return: Add Currency to Page Layout

Check the Currency is correct in the new VAT Return. The Currency field in the VAT Return is the ‘Submission Currency’ (ie: EUR for ROI and GBP for UK).

And the following fields need to be updated in the first return:

- VAT Return: VAT Registration Format

This is the PDF Format which has the VAT Number for the ‘foreign’ VAT Return.

Advanced Setup:

- MTD for Accounting Seed: Best Practice for migrating VAT data ->>

- MTD for Accounting Seed: Debugging Problems ->>