VAT Return Adjustments

In some rare circumstances you may need to manually adjust the box values in your VAT Return. Please get in contact to discuss this if you think you need to make VAT Return Adjustments.

TO ENSURE COMPLIANCE YOU MUST CONFIRM THIS IS WITHING THE VAT RULES

This requires some special setup:

1. Update Custom Setting

In the Custom Setting aiASVsettings and tick ‘Allow VAT Adjustments ‘

2. Change the Page Layout

Change the ‘VAT Return’ Page Layout to ‘VAT Submission Adjustment Layout’

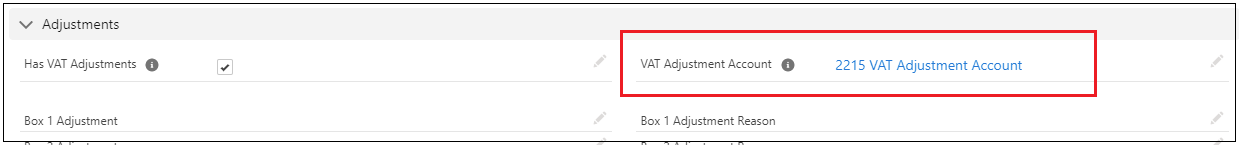

3. Setup VAT Adjustment Account

Navigate to the VAT Return record and scroll down to the ‘Adjustments’ section. There you can setup the ‘VAT Adjustment Account’.

Adjustment amounts will be posted to the ‘VAT Adjustment Account’ you define and the ‘VAT Liability Account’ setup before (see below)

4. Process the VAT Return

Process the VAT Return in the normal way (do NOT close or submit!) and determine what manual adjustments are required.

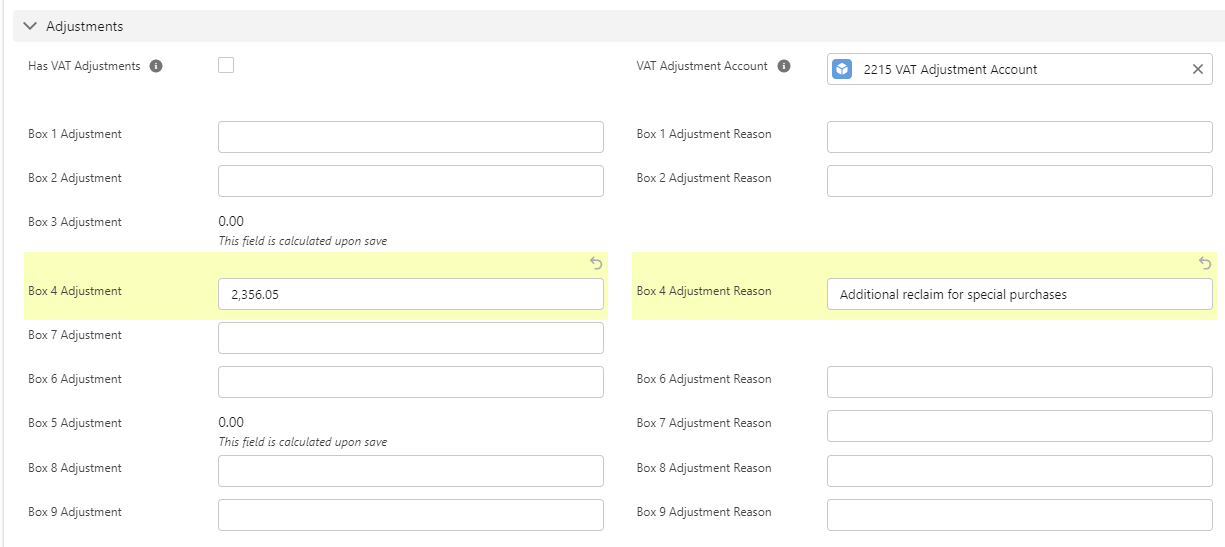

5. Enter the manual adjustments

Navigate back to the VAT Return record and scroll down to the ‘Adjustments’ section.

You can enter the ‘Adjustment’ amount but you MUST also enter an, ‘Adjustment Reason’

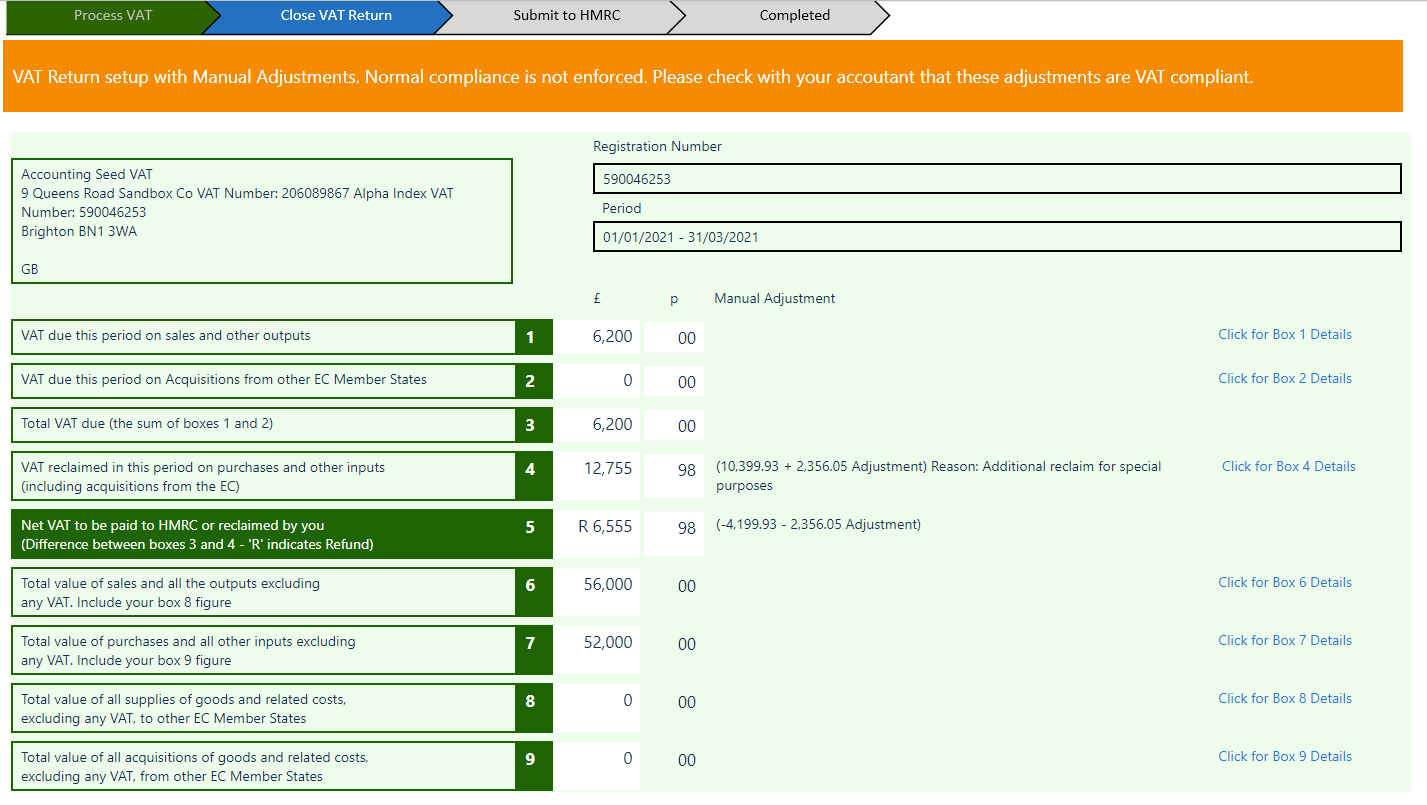

6. Close and Submit

Click on the [VAT Return] button and you will see the Adjustments are include in the Box Values:

The Journal Entry created will make the normal VAT Return postings, but also post the Adjustments to the ‘VAT Adjustment Account’ and ‘VAT Liability Account’